On January 1st of this year, a new tax law went into effect that changed tax brackets for the first time in more than 30 years. I wrote about this when the law first passed. The Tax Cuts and Jobs Act or TCJA is important because it could change the amount you pay in taxes next year.

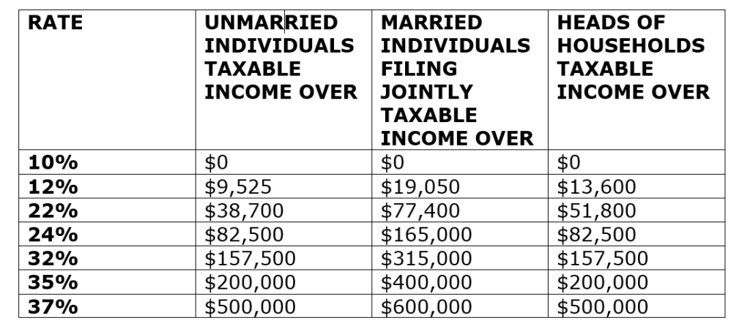

Well this week, the tax brackets and 2018 rates are out. The rates start at 10% for individuals with no income and up to 37% for taxpayers with taxable income of $500,000 and higher.

The new tax law eliminates personal exemptions and puts limits on itemized deductions. However, the standard deduction for single filers will go up by $5,500 and $11,000 for married couples filing jointly. There’s also a child tax credit expansion.

When you file your taxes this year, if you make more than $418,400 for single filers and $470,700 for married couples, then you pay an income tax rate of 39.6 percent. Next tax year, 2018, that number will be less with the tax rate dropping to 37%. Here are the 7 new tax brackets for 2018:

Don’t expect these rates to take effect when you’re doing your taxes this year. There will be no changes until 2018. But speaking of taxes, I hope your books are in order, your bank accounts and credit cards are reconciled, and your receipts are saved and ready to give to your bookkeeper and accountant before filing your 2017 taxes. If not, now is the time to get your books in order. If you need help with this, email me or give me a call. One of our Brigade Bookkeeping team members is here to help you.